Month-End Currency Revaluation – For Systems With Multiple Currencies

Important

Only required if you have more than one currency e.g. CAD and USD, if not skip to the next section “ar, ap, and bank”

Explanation

To reflect the current value of all foreign currency balances you need to run the “Adjust Exchange Rates” periodic activity. This process will revalue all open foreign currency receivables, payables, and bank balances. This process must be run to have the aged receivables, and payables and to reconcile your foreign currency banks. The recommended approach is to record a month beginning rate to be used to value all transactions during the month. Then record a month-end rate to revalue all open transactions.

Currency Table Setup

Note

If the automated currency update routine is running there is no need to maintain the following table.

For example:

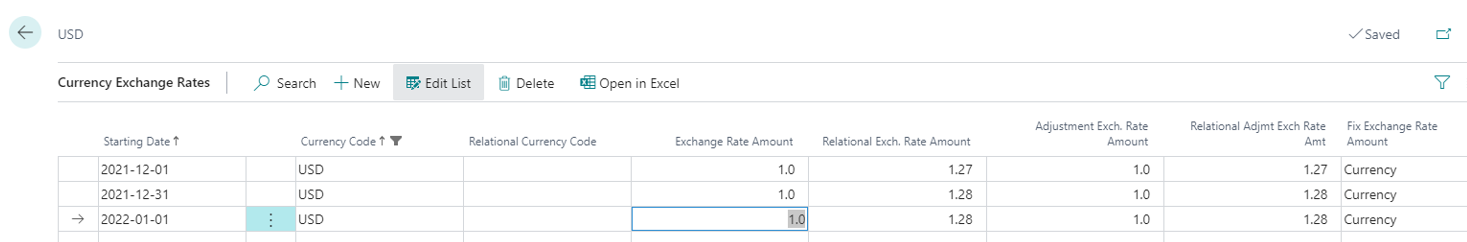

Enter the month-ending rate in the currency table.

Select the currency and click the Exch. Rates Button. The entries in this table should be like the above example.

Monthly Update Routine

Important

Make sure that you have run the Adjust Exchange Rate function after correctly setting up the currency tables and before assessing any foreign currency-based reports or values. You MUST do this before you try and assess currency-based sub-ledgers (AP, AR and Bank) before completing this task.

Run the Adjust Exchange Rate function.

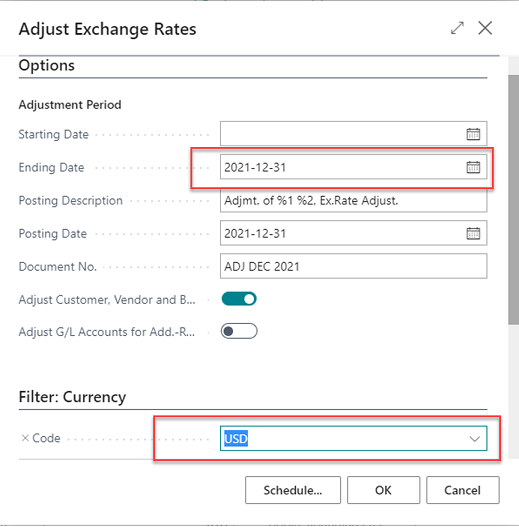

- Enter the currency you are going to adjust.

- Enter the period end date as the ending date. Leave the start date blank. This means adjusting all open entries regardless of what the invoice date was.

- Leave the recommended description as is. The %1 and %2 reflect codes that will end up giving you the currency code and amount adjusted in the description field of the GL entry.

- Enter a document number. Ideally, something that will easily identify this as the result of the currency revaluation. For example, ADJ DEC 2021.

- Check the Adjust Customer, Vendor and Bank Accounts.

Click OK. Note: no report will print.

Note

To review the effect of the adjustment, you can print the GL Register, or you can look at the Exch. Rate Adjmt. Registers. When you post the application of cash or post a cheque the unrealized gain or loss is reversed, and a realized gain is posted. It is because of this process the adjusted exchange rate cannot be run historically. All entries that were paid after the month's end will not be revalued as they are no longer open. To avoid this situation do not apply foreign currency cash against customers or vendors prior to balancing the accounts.