Manual application for retainage

To manually apply an invoice with retainage to a credit memo with retainage, or invoices with retainage to an invoice with retainage release, use the action "Apply Retainage Entries" in the "Customer Retainage Entries" page.

Action "Apply Retainage Entries" (example for credit memo)

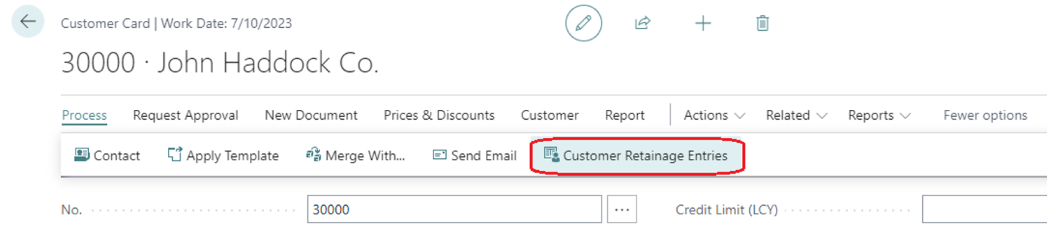

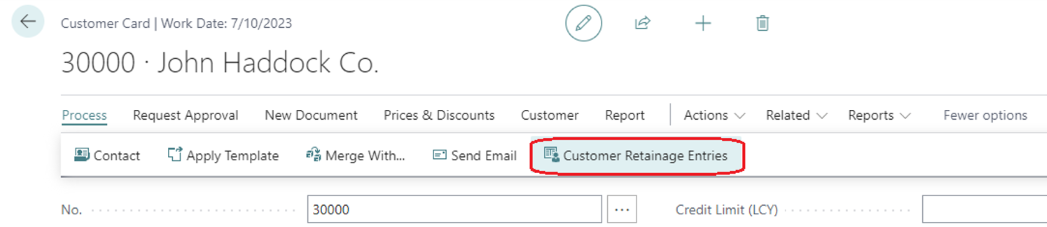

Open Customer Card and go to Process, then select Customer Retainage Entries.

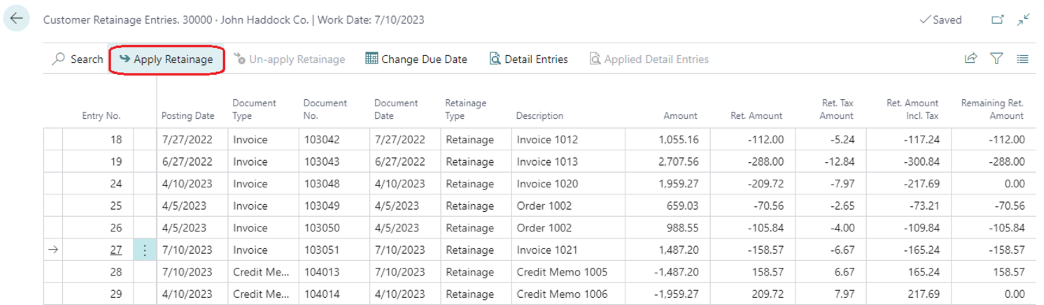

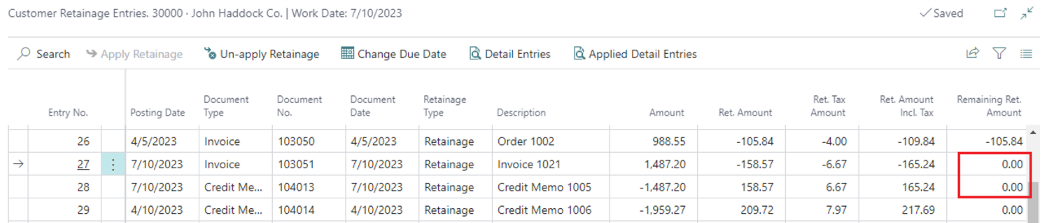

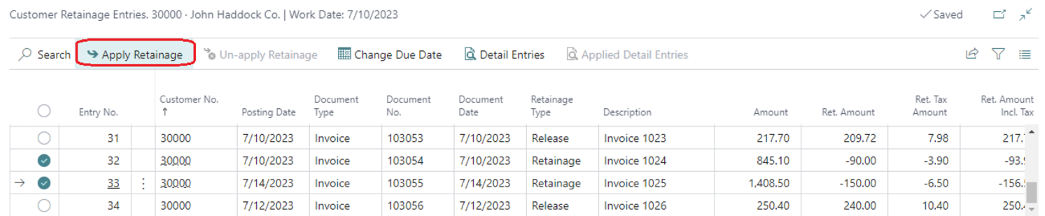

In the page "Customer Retainage Entries", select the line with the Invoice to be applied.

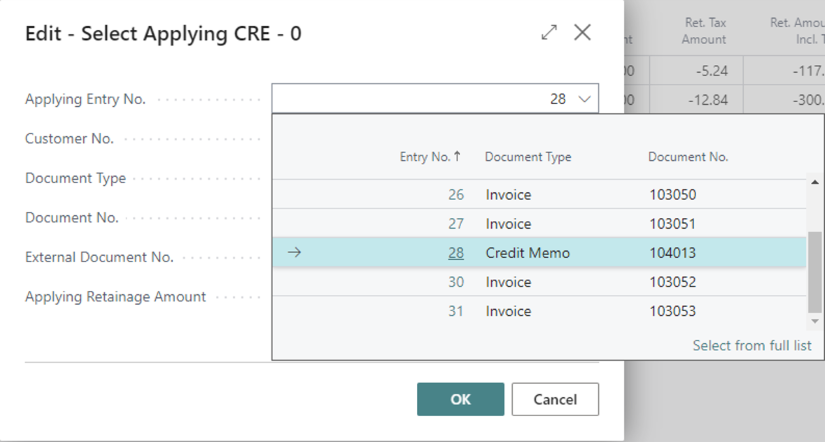

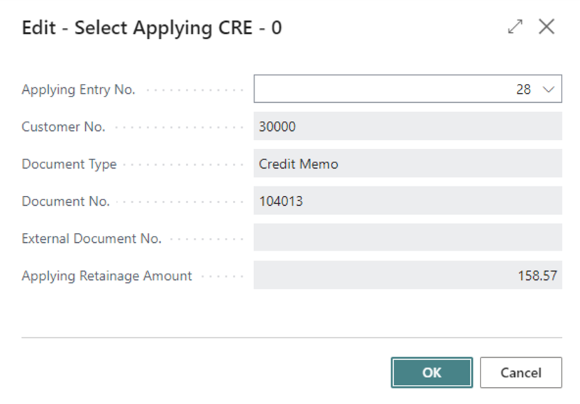

Run action "Apply Retainage." In the pop-up window, select applying credit memo and press "OK".

The results of the action will be the following:

- In page "Customer Retainage Entries, field "Remaining Ret. Amount" for both Invoice and Credit Memo became 0.00.

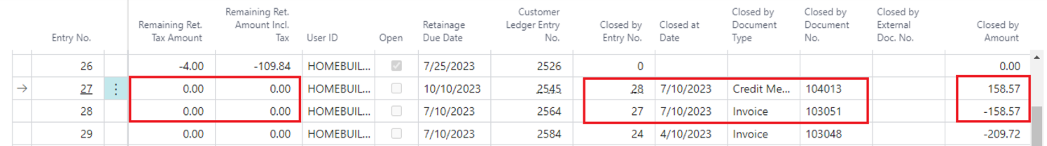

- Field "Open" for both Invoice and Credit Memo became "False".

- Field "Closed by Entry No." is populated with Entry No. of the opposite document.

- "Closed at Date" is populated with the latest posing date of the documents participating in the application.

Important: The documents can be applied for retainage only if the amounts for each tax combination (Tax Liable, Tax, Area Code, Tax Group) for applied documents match the amounts for the same tax combinations in the applied document.

Action "Apply Retainage Entries" (example for releasing invoice)

Open Customer Card and go to Process, then select Customer Retainage Entries.

Select lines for invoices with outstanding retainage and press "Apply Retainage".

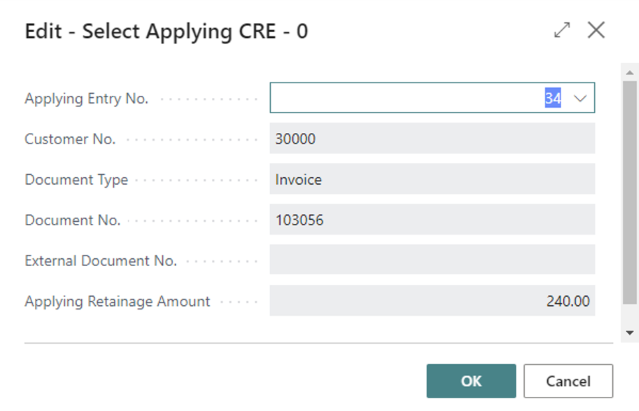

In the page "Select Applying VRE," select Customer Retainage Entry for an invoice with retainage release lines and press "OK".

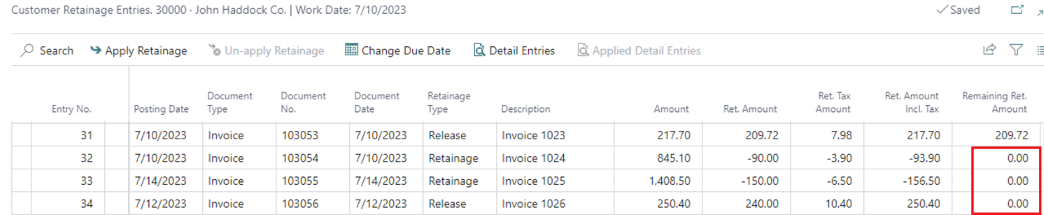

The results of the action will be the following:

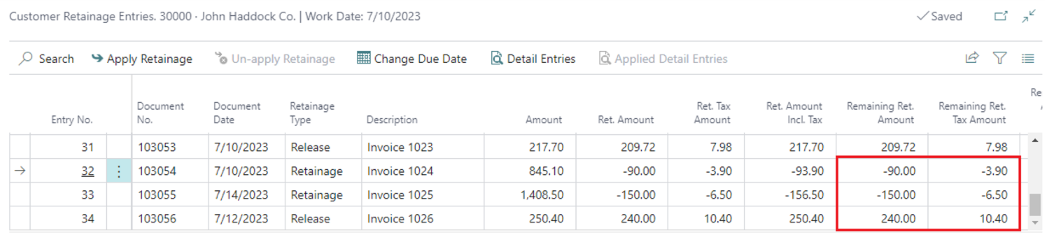

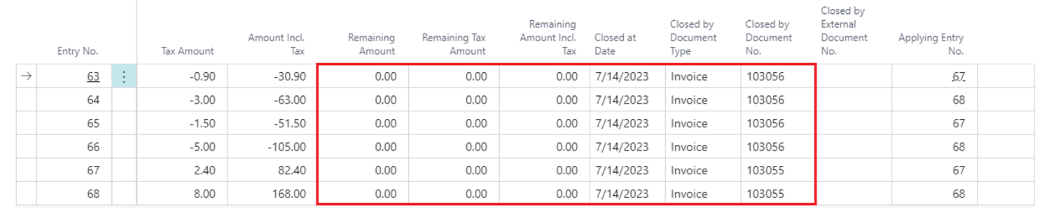

- In the page "Customer Retainage Entries,” the field "Remaining Ret. Amount" for retainage invoices and releasing invoices became 0.00.

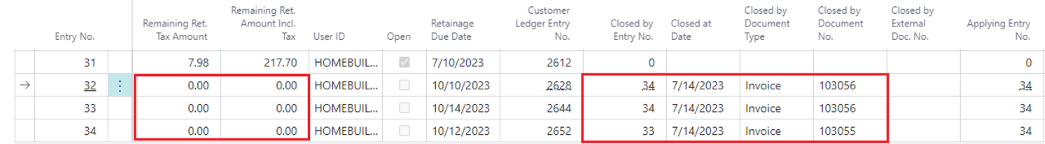

- Field "Open" for retainage invoices and releasing invoices became "False".

- Field "Closed by Entry No." is populated with Entry No. of the opposite document.

- "Closed at Date" is populated with the latest posing date of the documents participating in the application.

Important: The documents can be applied for retainage only if the amounts for each tax combination (Tax Liable, Tax, Area Code, Tax Group) for applied documents match the amounts for the same tax combinations in the applying document.

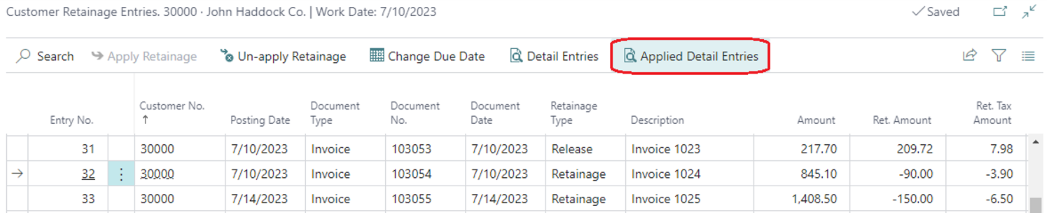

Action "Applied Detail Entries"

To see applied Detail Customer Retainage Entries for the document, go to the "Customer Retainage Entries" page, select Customer Retainage Entry for this document, and run the action "Applied Details Entries".

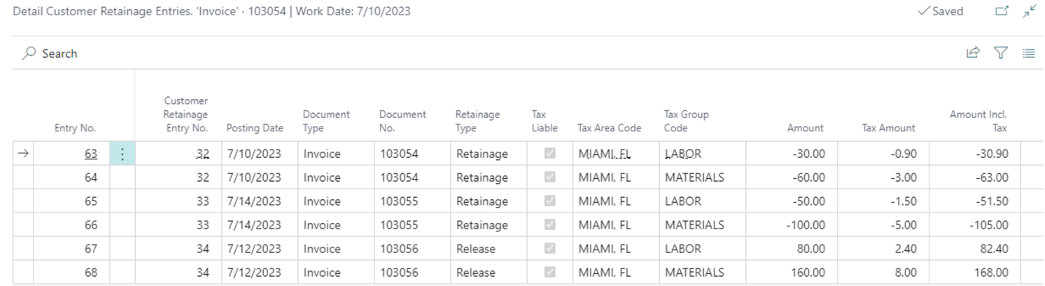

This will open the page "Detail Customer Retainage Entries" which shows application records, one record for each tax combination (Tax Liable, Tax Area Code, Tax Group Code).

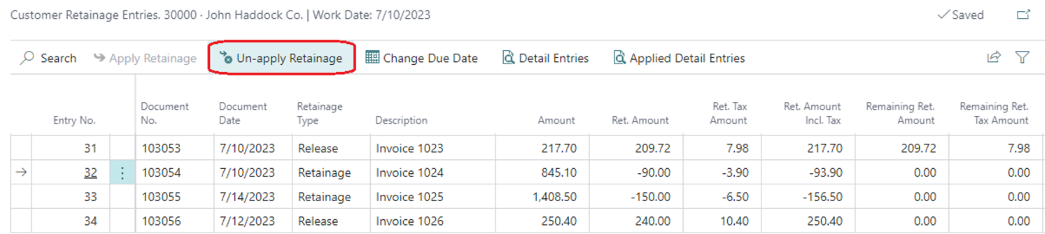

Un-apply for Retainage.

To un-apply a sales document for retainage, go to the "Customer Retainage Entries" page, select the entry for this document, and run the action, "Un-apply Retainage."

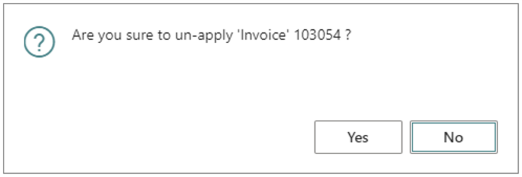

Confirm the un-application.

As a result, the remaining retainage amounts will be restored to previous values.