Non-Costruction Inventory Items

Important

Only required if you use non-construction inventory items, if not skip to the next section Month End Currency Revaluation for Multicurrency Environments.

Inventory Cost Adjustment Process

Month end procedures related to inventory should be done as close to the month end or period end as possible.

- Post all receipts and shipments on or before the month end date. Post any adjusting entries in the item journals. Invoice all jobs that can be invoiced.

- Investigate and correct Negative Inventory Quantities.

Important

If you do not correct negative Remaining Quantity values you will have incorrect inventory values. If you leave this for more than a few months, it can become very difficult to correct and catch up.

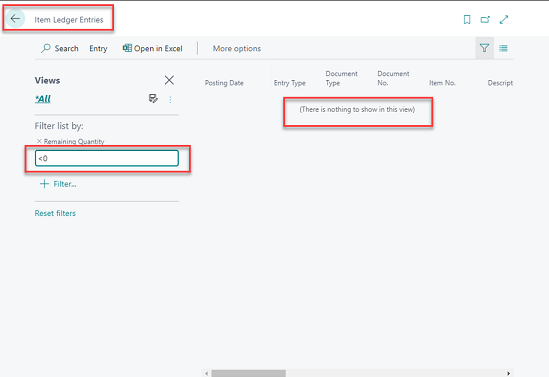

- Search for “Item Ledger Entries” from the magnifying glass.

- Filtering the Item Ledger Entries for Remaining Quantity < 0

- The list should be empty as shown below. If not, adjust inventory as required to eliminate negative inventory.

- Run the inventory periodic activities. The adjust cost routine ensures that all costs from positive item ledger entries have been passed on to the appropriate negative or sales item ledger entries. For example if you received an item at $0 cost because you did not know the purchase price then sold this item the cost of goods sold is $0. Subsequently you posted the purchase invoice at $10 then the system has to find the sales entry and increase the cost of goods sold to $10.

More an that on MS Learn:

Important

Make sure that you have run the inventory periodic activities BEFORE assessing any inventory reports or values. You will be wasting your time if you try and assess inventory before completing this task.

- You should run both inventory periodic activities even if you have turned on all the automated adjustments in the Inventory Setup – if all the automated cost adjustment run at the time of posting then these periodic activities will complete immediately

- Firstly, run the periodic activity Adjust Cost – Item Entries. From Financial Management Menu / Inventory / Costing / Adjust Cost Item Entries. Make sure that Posting is checked on, click OK

- Note 1: you will not get a report from this process.

- Note 2: the date on which the transactions are posted (related to a closed period) is the “Allow Posting From” date from the General Ledger Setup.

- Secondly, run the periodic activity Post Inventory Cost to GL (report) Select Per Entry on the options tab and check on Post.

- Note: The “Per Entry” option will create many value entries; if there is a requirement to restrict growth of the database size choose the “Per Group” option e.g. for use with many stores in a ChargeLogic installation

Inventory Periods (Normally Not Used)

Close the Inventory Period if you use them.

The reasons to use and consequences of not using the Inventory Period Table are as follows:

- Maintaining the Inventory Periods means that inventory adjustments are not posted to a month that is closed and reconciled.

- If you do not maintain an Inventory Period list then adjustments e.g. rounding can be made dating all the way back to the originating transaction e.g. purchase.

Note

The Inventory Period table is structured using “End Date” unlike the financial Period table that is structured using “Start Date”

Open the Inventory Periods page.

Go to the period that you wish to close.

Click on the “Close Period” button in the ribbon – Accept the message by pressing Yes.

From now any adjustments will be made only in the open period rather than going back to the original transaction and adjusting at that date.

Please note that you must open the general system periods (irrespective of the user periods) to allow the system to post cost adjustments into the new period. To do it, search: Accounting Periods.

- Ensure that you have BOTH from and to dates.

Inventory Reconciliation

Print the Inventory Valuation and Inventory to GL Reconcile Reports.

- Print the Inventory Valuation report. On the Options tab, enter the period end date as the “As of Date”.

-

Print the Inventory to GL Reconcile Report. On the Options tab, enter the period end date as the “As of Date”. - The far left column of the Inventory to GL Reconcile Report should agree to the Inventory Valuation report.

Reconcile the Inventory to GL Reconcile Report to the inventory accounts in the General Ledger. The Inventory to GL Reconcile Report will explain the difference between the sub-ledger and the general ledger. These differences are generally from Received Not Invoiced and Shipped Not Invoiced amounts.

- If required you should book an accrual for the received not invoiced. Create an entry to debit inventory and credit accrued Accounts Payable balance on the value in the Received not Invoiced column on the Inventory to GL Reconcile Report.

- As an alternative to the Inventory to GL report, you may choose to use the AP to GL Reconcile report instead. The AP to GL Reconcile report will pick up all purchasing lines where quantity received not invoiced is populated. It will also use the direct unit cost on the purchase line, which may be different from the estimated cost in the item ledger entries.