Work In Process (WIP) in HomeBuilder Introduction

Only some Homebuilders use the Work in Process (WIP) subledger to manage their operations. Most do not use it as the perceived value of information does not justify the additional administrative burden the organization would have to bear. We observed that the larger and more complex builder's operations, the more inclined they are to use WIP. Also, for multi-year projects like land development, using WIP might be useful.

There are two WIP calculation methods that are used by Builders:

- Completed Contract.

- Percentage of Completion.

Time and Materials Projects are not in use by Homebuilders and this is why we did not include them in HomeBuilder Help Files. These Projects do NOT use WIP.

Note

Work in Process is also called Deferred Revenue.

The standard Business Central functionality does offer additional WIP calculation methods:

- Cost of Sales.

- Cost Value.

- Sales Value.

These will not be covered in our Help Files as they were never used by our Homebuilding clients.

Percentage of Completion WIP Calculation Method

Percentage of Completion calculates WIP as the contractual value (sales value) of actual usage cost value (Project ledger entries), measured by the cost value of expected usage (your budget). Using this method means that the revenue and profit (or loss) of the Project will be recognized as the Project costs are incurred and recognized. The Percentage of Completion method is recommended by some international accounting standards.

For this method, the WIP Amount is always posted to the WIP Accrued Sales account (an asset account), while the value of the Contract (Invoiced Price) will be posted to the WIP Invoiced Sales (contra asset or liability account).

The WIP is calculated with the following formula:

- WIP Calculation for Percentage of Completion Method = WIP Amount in Project Task - Invoiced Sales Amount in Project Task.

- WIP Amount in Project Task = Usage Total Cost + Schedule (Total Cost) * Contract (Total Price).

- Invoiced Sales Amount = Contract (Invoiced Price).

- WIP Sales Amount = WIP Amount.

- Recognized Sales Amount = WIP Amount.

- WIP Cost Amount = Usage (Total Cost).

- Recognized Costs = Usage (Total Cost).

In short, this method will calculate WIP based on your costs incurred (Usage Total Cost) vs. your Budget Total Cost. (This is where the percentage is calculated from)

This is a more complex method. Its advantage is that the revenue is being recognized simultaneously as the costs are recognized which results in financial information reflecting progress in incurring costs and reflects that on the revenue side.

- You must have a budget on the Lot to use this method (as it uses the Budget Total Cost to calculate your Percentage of Completion as you incur actual costs).

Completed Contract WIP Calculation Method

WIP Amount = WIP Cost Amount = Usage (Total Cost). WIP Sales Amount = Billable (Invoiced Price).

The Completed Contract does not recognize revenue and costs until the Project is complete. You may want to use this method when there is high uncertainty around the estimates of costs and revenue for the Project.

All usage is posted to the WIP Costs account (asset) and all invoiced sales are posted to the WIP Invoiced Sales account (in your example an asset account, but it can be a liability account) until the Project is complete.

In short, everything goes to the WIP subledger until you set the Project Status as Completed. You do not recognize costs or revenue until the project status is set to Completed.

This is a simpler of the two methods to grasp and use.

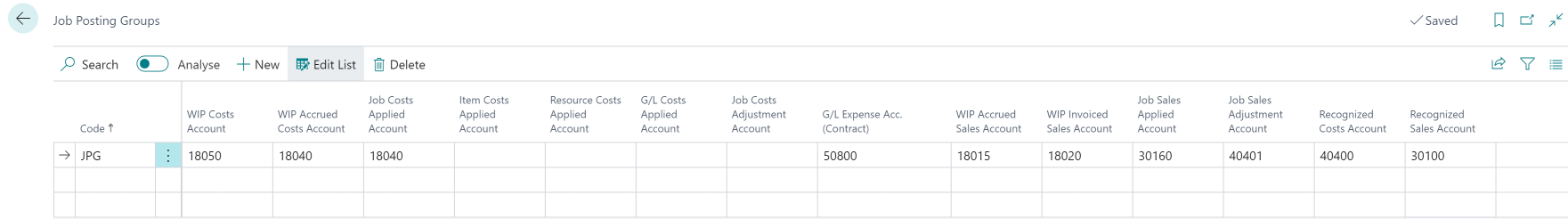

Project Posting Setup

We recommend the following setup for your WIP:

To access, search Project Posting Groups.

The descriptions of the G/L accounts used in the Project Posting Group Setup are as follows:

- WIP Costs Account.

- This is your base WIP account. Specifies the work in process (WIP) account for the calculated cost of the Project WIP for Project tasks with this posting group. The account is normally a balance sheet asset account.

- WIP Accrued Costs Account.

- Specifies an account that accumulates postings when the costs recognized, based on the invoiced value of the Project, are greater than the current usage total posted if the WIP method for the Project is Cost Value or Cost of Sales. The account is normally a balance sheet accrued expense liability account.

- Project Costs Applied Account.

- Specifies the balancing account for the WIP Cost account for Projects. The account is normally a balance sheet accrued expense liability account or an expense (credit) account.

- G/L Expense Acc (Contract).

- Specifies the sales account to be used for general ledger expenses in Project tasks with this posting group. If left empty, the G/L account entered on the planning line will be used.

- WIP Accrued Sales Account.

- Specifies an account that will be used when the revenue that can be recognized for the Project is greater than the current invoiced value (for the Project) if the work in process (WIP) method is Sales Value.

- WIP Invoiced Sales Account.

- Specifies the account for the invoiced value, for the Project for Project tasks, with this posting group.

- Project Sales Applied Account.

- Specifies the balancing account to WIP Invoiced Sales Account The account is normally a contra (or debit) income account.

- Recognized Costs Account.

- Specifies the account for recognized costs for the Project. The account is normally an expense account. At the end of the WIP process, this is where all the costs are going to end up.

- Recognized Sales Account.

- Specifies the account for recognized sales (or revenue) for the Project. The account is normally an income account. At the end of the WIP process, this is where all the revenue is going to end up.

Note

There are 4 accounts that were not populated in the Project Posting Setup:

- Item Costs Applied Account.

- Resource Costs Applied Account.

- G/L Costs Applied Account.

- Project Costs Adjustment Account.

These G/L accounts are used by the other WIP Calculation methods typically not used by homebuilders (or even other industries). However, if your operations require them to be configured, commonly you can:

- Create a G/L Account WIP Costs Applied Account.

- Use it to populate all 4 Project Posting Group Categories.

- If you need more granular financial tracking, you can create additional G/L Accounts and assign them to the 4 Project Posting Group categories.

Important

Search General Posting Setup and ensure its completeness. Specifically, select COGS Account.

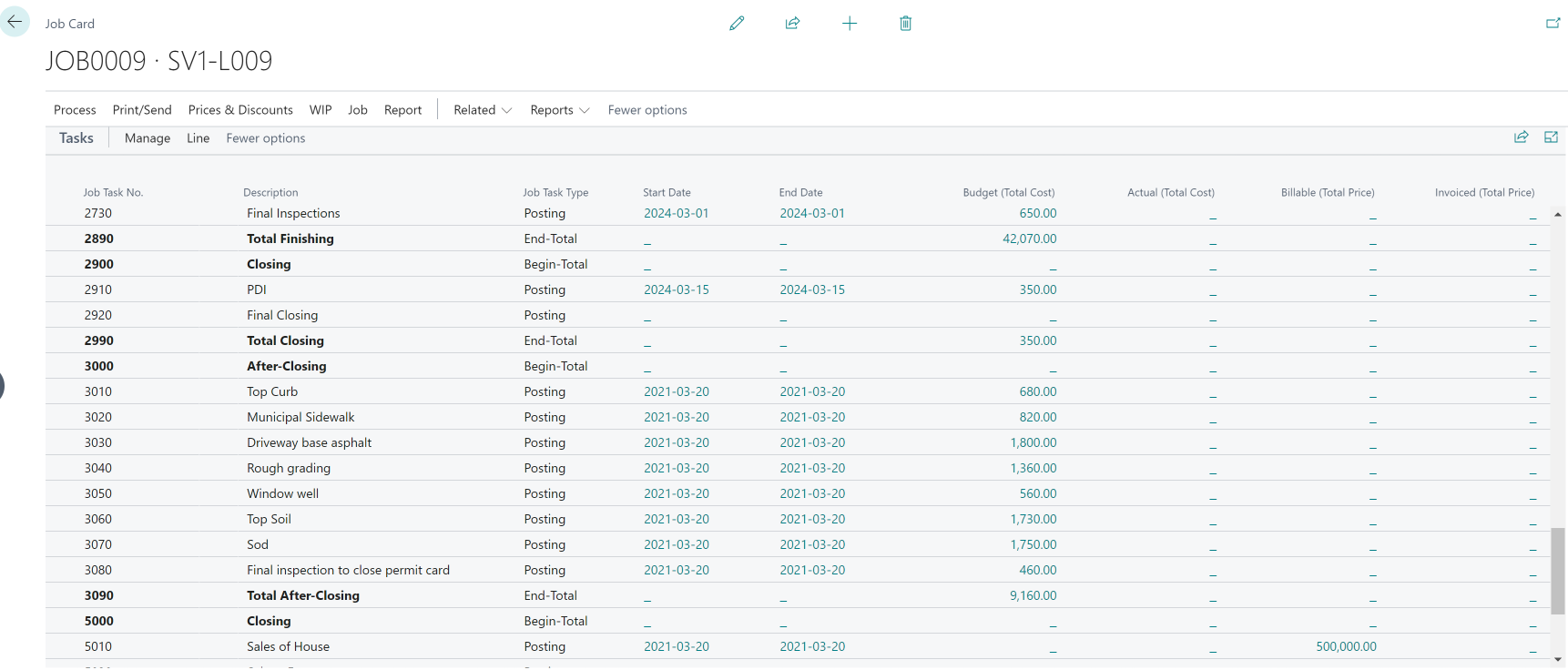

Lot Budget

Projects in Business Central are Lots in Homebuilder. That means that some functions regarding calculation WIP on the Lot will require to search and use Lots, and sometimes search Projects and use Projects functionality.

Details on setting up and managing Budgets can be found in these articles:

To perform WIP calculations, you will need a Budget on the Lot. The budget is inherited from the actual model that will be constructed on the Lot or from a "template Model" that you just assign to the lot to create Budget Lines common to all the Lots.

It is a brand-new budget with no postings in it.

This is a budget on Lot 9, and it is shown here as Project 9. We will use this same budget for both WIP Calculation Methods. Select the link below to navigate to the Method you will be using:

or

Note

- Lot Planning Lines contain detailed lines, i.e.: there could be a couple of lines for each Project Tasks Number. However, when you search Projects and look at the Budget Total Cost field, you will notice that it contains 1 line and the sum of costs per Project Task Number.

- The main interplay is between HomeBuilder Lot Planning Lines and Business Central Projects Module and their Budget (Total Cost) and Actual Cost fields.

- In 2024 Business Central changed the table/ functionality name from Jobs to Projects. The screenshots still contain the old name, i.e.: Jobs

Note

WIP G/L Postings do NOT contain any Dimension information. (Lot, Phase). This information is recorded during the process of:

- Purchasing.

- Selling.

from your Planning Lines. Planning Lines contain this information and Purchase (or Sales) Lines inherit this information from them.