WIP Completed Contract Method

Note

- This Article builds upon your knowledge contained in the Help File Work In Process (WIP) in HomeBuilder

- The article WIP Percent of Completion Method explains the mechanics of the numbers flow between the WIP subledger and the G/L. It might be beneficial to get familiar with its contents if you are a controller or perform administrative tasks in this area.

- In 2024 Business Central changed the table/ functionality name from Jobs to Projects. The screenshots still contain the old name, i.e.: Jobs

As mentioned before, the Completed Contract does not recognize revenue and costs until the Project is complete. You may want to use this method when there is high uncertainty around the estimates of costs and revenue for the Project.

All usage is posted to the WIP Costs account (asset) and all invoiced sales are posted to the WIP Invoiced Sales account (liability) until the Project is complete.

You start with the same setup as for the Percent of Completion Method. This article runs parallel to the Percent of Completion Method, therefore, the first section "WIP Percent of Completion Method" and the second section "Calculate WIP Action" repeat and are omitted in this article.

Here is what the omitted 2 sections from the Percent of Completion Method contain in summary:

- WIP accounts have no postings.

- In WIP and Recognition FastTab there is nothing to post (and nothing is posted).

To start, ensure that on the Project Card, posting FastTab, the WIP Method is set to Completed Contract and the Project Status is set to Open.

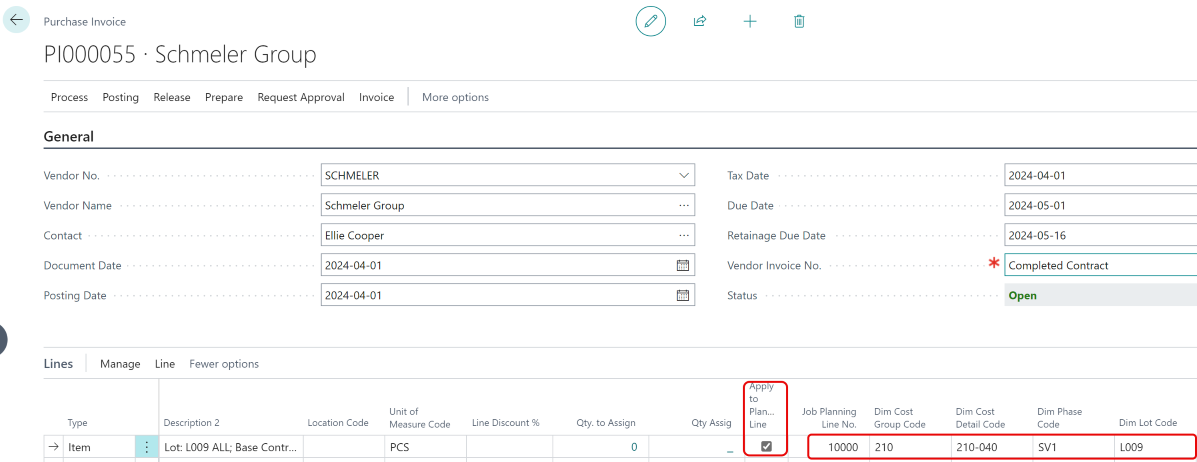

At this point, you can post 100,000 costs to your Planning Lines

- To Purchase, use Purchase Invoice Card, then from the Process Menu, select Populate from Planning Lines just like in the Percentage of Completion Method

- Note that when using Populate from Planning Lines:

- The thick "Apply to the Planning Line" is marked.

- Dim Cost Group Code, Dim Cost Detail Code, Dim Phase Code, and Dim Lot Code are going to be populated from the Planning Line. See the highlighted part of the screenshot.

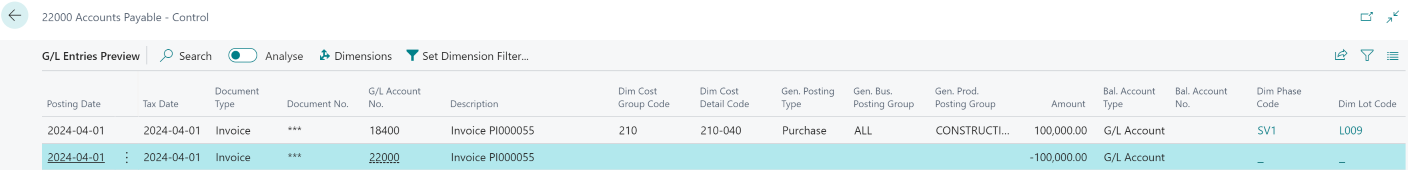

- 22000 is Accounts Payable account.

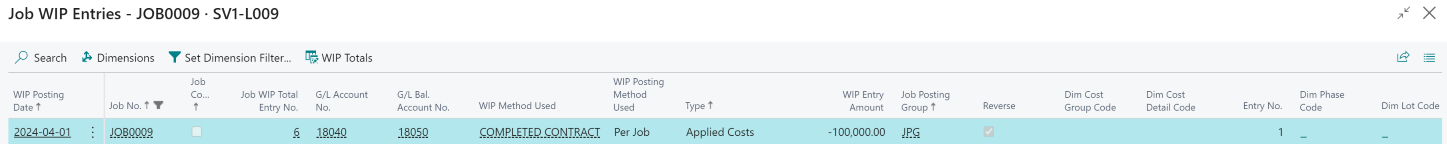

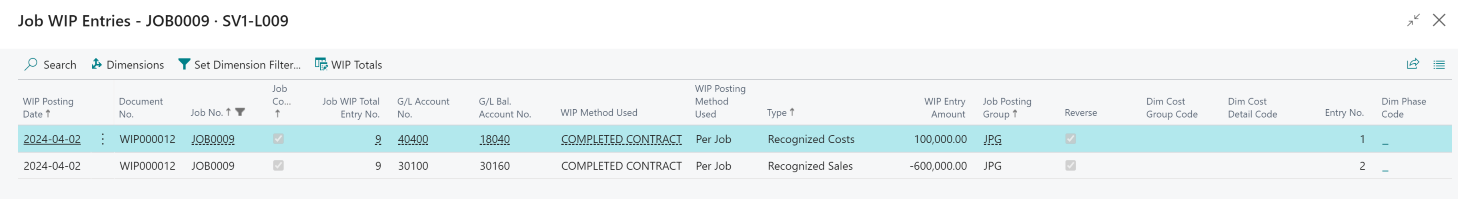

Now, on the Project Card, from the WIP Menu, select Calculate WIP That Action will result in the following Project WIP Entry:

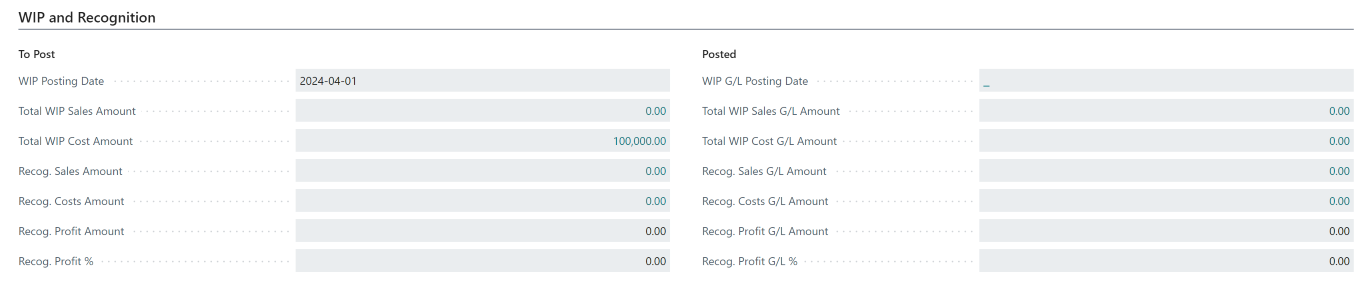

On the WIP and Recognition Tab, you have 100,000 on the left, i.e.: To Post, side.

- Note that this is not in the General Ledger yet.

The next step is to post to the General Ledger. From the WIP Menu, select Post WIP to GL. It will result in the following Project WIP General Ledger Entries:

In this part of the example, you will sell the house to a customer. From the list of customers, choose the one assigned to the Lot you work on. On the Customer Card, from the New Document menu, select Sales Invoice.

- It will pull up the Sales Invoice Card populated with this Customer information.

From the Process Menu, select Populate from Planning Lines Action Button. Upon the invoice posting:

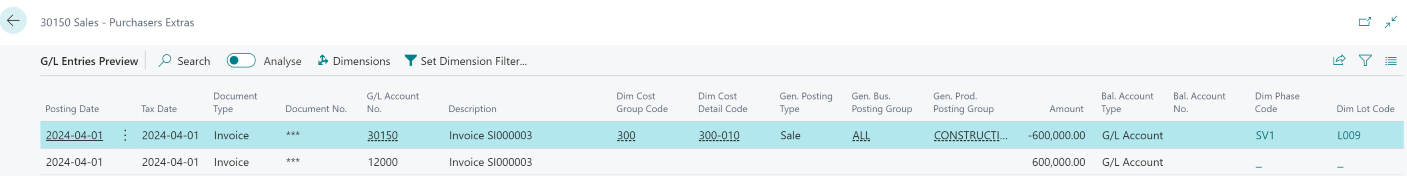

- Note that the 30150 on the credit side received the Dim Cost Group Code, Dim Cost Detail Code, Dim Phase Code, and Dim Lot Code. This Account is set as a Sales Account in the General Posting Setup. 12000 Account, receiving debit entry is the AR account.

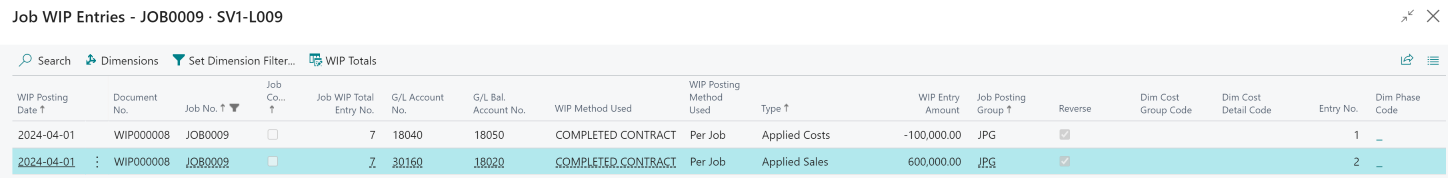

During your regular company operations, you will keep adding costs and perhaps sell Selection Packages (Color Charts). In the example, however, you will be finalizing the Project Closing Process. From the WIP Menu, select Calculate WIP. The system will prepare these Project WIP entries:

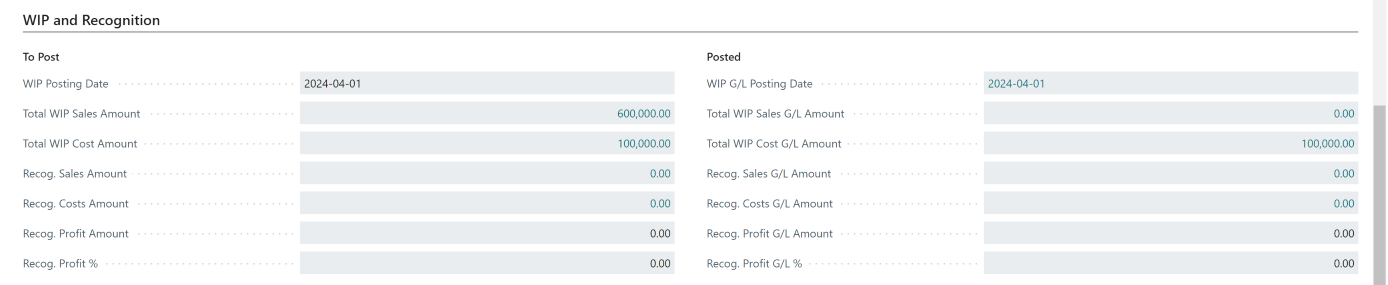

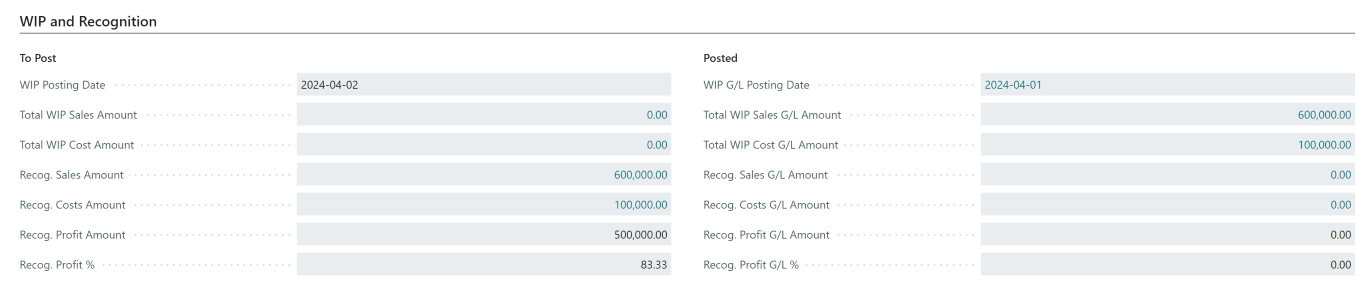

Your Total WIP and Sales amount and Cost Amount are ready to be posted:

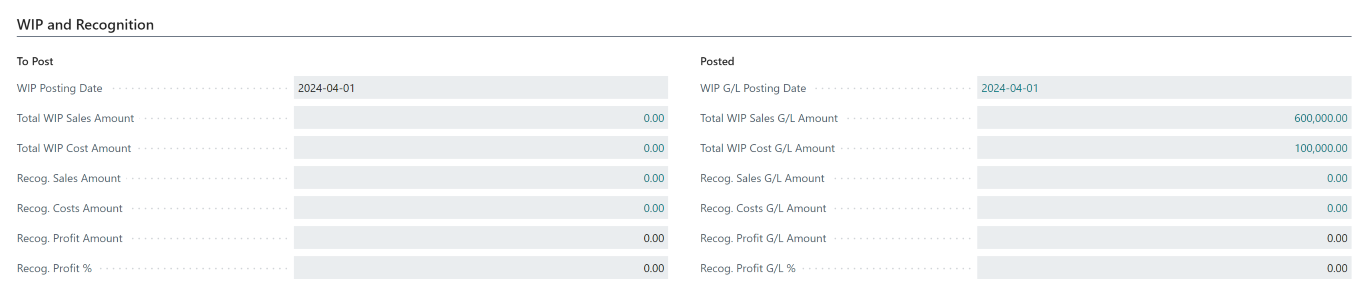

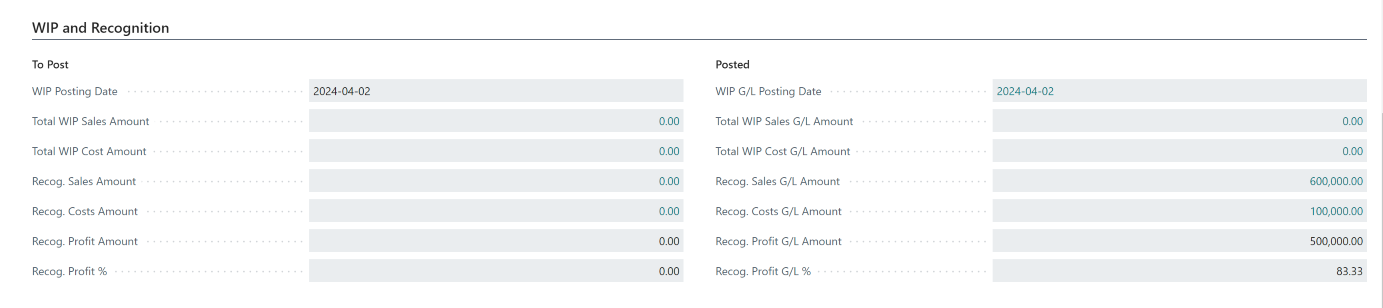

From the WIP Menu, select Post WIP to G/L. This will post WIP "To Post" amounts to the Posted Section and will Post to the General Ledger:

Note that none of the costs or revenue is recognized yet. Since this is a Completed Contract Method, any recognition will take place once, on the Project Card, you go to the Posting FastTab and set the Contract Status from Open to Completed.

The following Project WIP Entries (no effect on G/L yet) and no Dimension information:

resulted in the following WIP and Recognition- "To Post" side numbers:

After posting WIP to G/L:

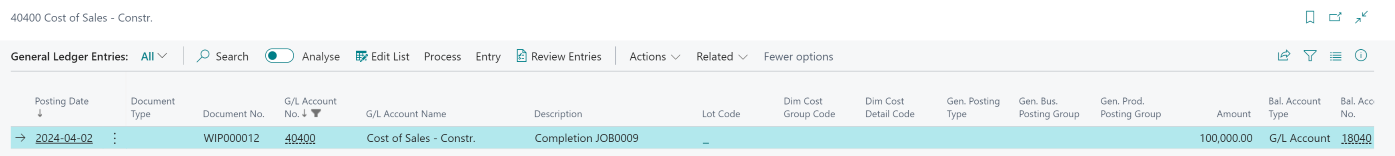

You can drill into any of the lines to see where the balances ended up, i.e.:

- Recognized Sales (Costs/Profit) G/L Amount.

or go to your COA. As a reminder, these are the accounts specified in the Project Posting Groups page. E.g. the Recognized Sales Account 30100

And your costs in 40400:

For the re-opening completed contract scenario, open the article WIP Re-opening Completed Contract